NV NUCS-4075 2012-2024 free printable template

Show details

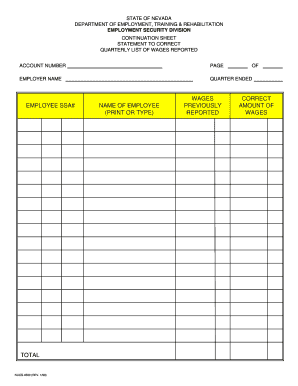

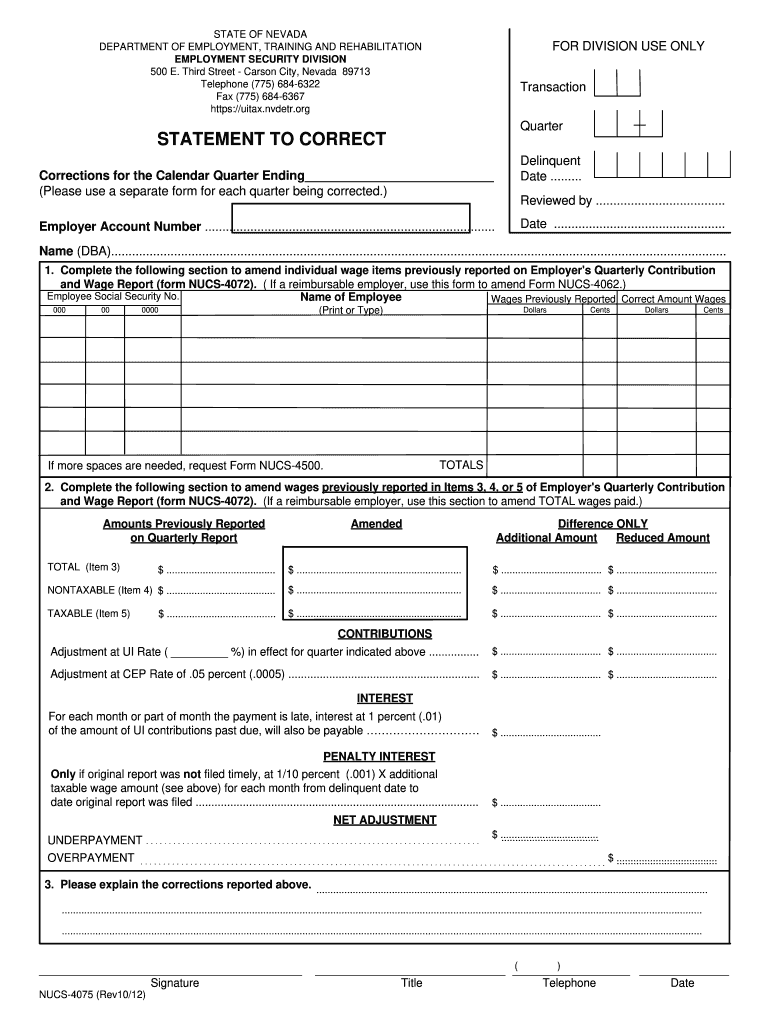

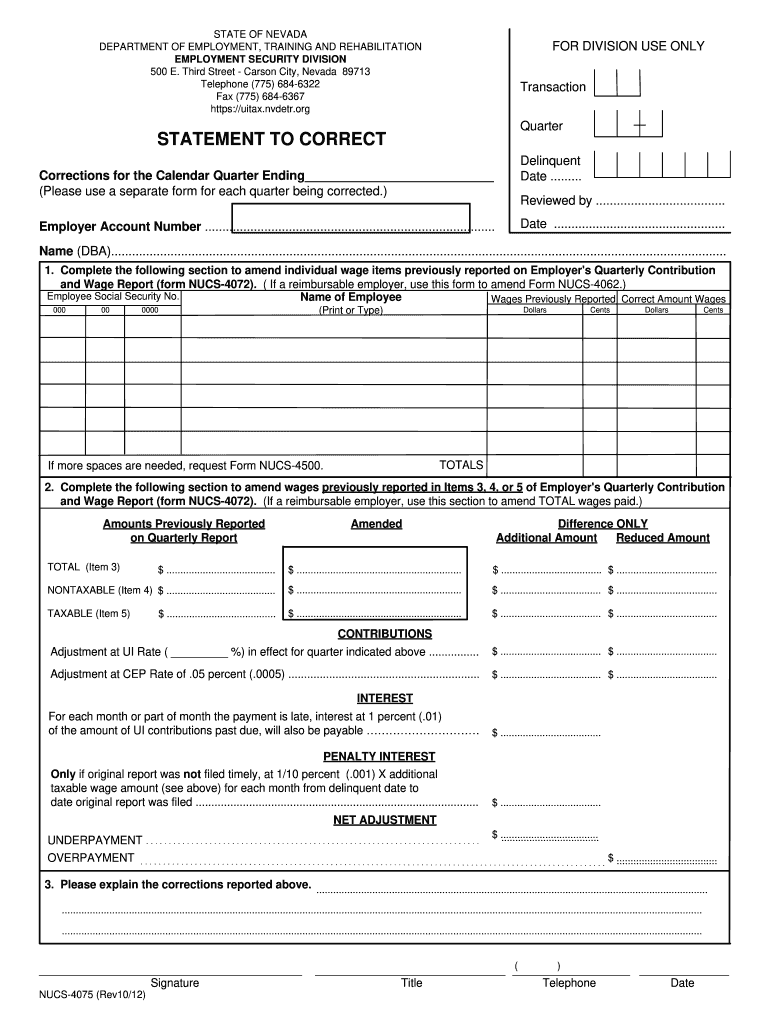

NET ADJUSTMENT UNDERPAYMENT OVERPAYMENT 3. Please explain the corrections reported above. Signature NUCS-4075 Rev10/12 Title Telephone Date. STATE OF NEVADA DEPARTMENT OF EMPLOYMENT TRAINING AND REHABILITATION EMPLOYMENT SECURITY DIVISION 500 E* Third Street - Carson City Nevada 89713 Telephone 775 684-6322 Fax 775 684-6367 https //uitax. nvdetr*org FOR DIVISION USE ONLY Transaction Quarter STATEMENT TO CORRECT Corrections for the Calendar Quarter Ending Please use a separate form for each...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form nevada form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nevada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form nevada online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employee nevada form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out form nevada

How to fill out form Nevada?

01

Read the instructions: Before starting to fill out the Nevada form, carefully read the instructions provided. This will give you a clear understanding of the purpose of the form and the information you need to provide.

02

Gather required information: Collect all the necessary information and documents before beginning to fill out the form. This may include personal details, financial information, employment history, legal documentation, etc. Ensure you have all the required information handy to avoid any delays or mistakes.

03

Fill out the form accurately: Start by providing the requested personal information such as your full name, address, date of birth, contact details, etc. Make sure to double-check the accuracy of the information before proceeding.

04

Complete all sections: Carefully go through each section of the form and provide the required details. Different sections may ask for various types of information, such as employment history, financial information, or specific declarations. Fill out each section accurately and thoroughly.

05

Attach supporting documents: If any supporting documents are required to be included with the form, make sure to attach them neatly. These documents may vary depending on the purpose of the form, so refer to the instructions or guidelines provided.

06

Review and revise: Once you have completed filling out the form, take a moment to review all the information provided. Check for any errors or omissions and make necessary revisions before submitting the form.

07

Signature and submission: If a signature is required, sign the form in the designated area. Ensure that all necessary signatures are obtained if multiple parties are involved. Finally, follow the instructions on how and where to submit the form.

Who needs form Nevada?

01

Individuals residing in Nevada: The Nevada form is typically required for individuals who reside within the state of Nevada. It may be needed for various purposes such as employment, taxation, vehicle registration, voter registration, etc.

02

Businesses operating in Nevada: Certain forms related to business operations in Nevada may be required for companies operating within the state. These forms may include business registration, licensing, tax-related forms, etc.

03

Individuals seeking specific services: Some forms may be needed by individuals who are availing particular services or benefits such as healthcare, social assistance, education, etc. The specific forms may vary depending on the nature of the service being sought.

Video instructions and help with filling out and completing form nevada

Instructions and Help about 2014 nevada form

Fill net nucs 4062 download : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form nevada?

Form Nevada refers to the process of forming a business entity in the state of Nevada, United States. It involves registering and establishing a corporation, limited liability company (LLC), partnership, or other business structure in accordance with the laws and regulations of Nevada. This typically includes filing the necessary forms, providing required information, and paying the appropriate fees to the Nevada Secretary of State's office. Forming a business entity in Nevada can provide certain advantages such as favorable tax and asset protection laws.

Who is required to file form nevada?

There is no specific form called "Form Nevada." However, if you are referring to tax-related forms, individuals and businesses that have a taxable presence in Nevada or earn income from Nevada sources may be required to file various tax forms with the Nevada Department of Taxation. Requirements may vary depending on the type of entity, the amount of income, and the nature of the activities conducted in Nevada. It is advisable to consult with a tax professional or refer to the Nevada Department of Taxation's website for specific filing requirements.

How to fill out form nevada?

To fill out a form in Nevada, follow these steps:

1. Read the instructions: Start by carefully reading the instructions provided with the form. Make sure you understand what information is required and any specific guidelines for completion.

2. Gather necessary information: Collect all the information needed to complete the form. This may include personal details, such as your full name, address, social security number, and contact information. Depending on the form's purpose, you may need additional information related to employment, financials, or legal matters.

3. Use legible handwriting: If the form is to be filled out by hand, use clear and legible handwriting. Write within the designated fields and boxes in black or blue ink. Avoid using pencil or other colored inks.

4. Be accurate and honest: Provide accurate information and answer all required questions. Double-check the spelling of your name, addresses, and other important details.

5. Follow formatting guidelines: Some forms may have specific formatting instructions. Follow these guidelines, such as writing dates in the correct format or capitalizing information where requested.

6. Check for supporting documents: If the form requires any supporting documents, such as identification proofs or supporting evidence, attach them as instructed. Make photocopies of original documents if needed.

7. Review and proofread: Before submitting the form, carefully review all the information you have provided. Ensure there are no errors, omissions, or inconsistencies. Correct any mistakes or inaccuracies.

8. Sign and date: If required, sign and date the form in the appropriate sections. Read any instructions regarding signatures to ensure you comply with any specific requirements.

9. Make copies: It is advisable to make a copy of the completed form before submitting it. This will serve as a record for your reference.

10. Submit the form: Submit the completed form as instructed. This might involve mailing it to the appropriate address, submitting it in person at a designated office, or online submission, depending on the form and its purpose.

Remember to keep a copy of any submitted form for your records.

What is the purpose of form nevada?

Form Nevada refers to a specific form or legal document that is filed with the Nevada Secretary of State's office. The purpose of Form Nevada can vary depending on the specific context. Here are a few common reasons for filing Form Nevada:

1. Business Formation: Forming a new business entity, such as a corporation, limited liability company (LLC), or partnership, requires filing specific forms with the state. Form Nevada is used to officially register the business entity in the state of Nevada.

2. Business Registration: Form Nevada may also be used to register an existing business entity that was formed in another state but is seeking to expand its operations into Nevada, thus ensuring legal compliance and recognition in the state.

3. Foreign Qualification: For businesses that are based in other states but wish to operate in Nevada, filing Form Nevada as part of the foreign qualification process is necessary. This form allows such businesses to obtain the legal authority to transact business in Nevada.

4. Name Reservation: Form Nevada might be used to reserve a specific business name for a future filing. This ensures that the desired name will be available when the business is ready to officially register with the state.

It is important to note that the specific purpose of Form Nevada can vary depending on the legal requirements, business structure, and activities of the entity involved. Individuals or businesses should consult with an attorney or professional advisor to determine the specific purpose of filing Form Nevada in their particular situation.

What information must be reported on form nevada?

Form Nevada refers to the various forms that businesses and other entities may be required to file with the State of Nevada. The specific information that must be reported on these forms can vary based on the type of form being filed.

Here are some examples of common forms in Nevada and the type of information they typically require:

1. Nevada Articles of Incorporation: This form is used when forming a corporation in Nevada. It requires information such as the business name, registered agent, purpose of the corporation, number of authorized shares, names and addresses of officers/directors, and the name and signature of the incorporator.

2. Nevada Annual List (or Annual Report): This form is used to maintain an active status for corporations, limited liability companies (LLCs), and limited partnerships (LPs) in Nevada. It typically requires information such as the entity's name, registered agent info, principal office address, and the names and addresses of officers or managers.

3. Nevada Business License Application: This form is used to apply for a business license in Nevada. It typically requires information such as the business name, physical and mailing addresses, owner/manager information, employee count, and the nature of the business activity.

4. Nevada Sales and Use Tax Return: This form is used for reporting and paying sales tax in Nevada. It requires information such as the business name, sales amounts, taxable sales, deductions, and the calculated amount of sales tax owed.

5. Nevada Annual Report for Nonprofit Corporations: Nonprofit corporations in Nevada are required to file an annual report that includes information such as the organization's name, purpose, principal office address, and the names and addresses of directors and officers.

It's important to note that these are examples, and the specific requirements may differ depending on the form and the entity type. Additionally, other forms may be required depending on the specific activities and compliance obligations of the business or entity in Nevada. It is advisable to consult the Nevada Secretary of State's website or seek professional guidance to ensure accurate and up-to-date information for specific form requirements.

What is the penalty for the late filing of form nevada?

The penalty for late filing of Form Nevada, which is the Annual List of Officers and Directors for corporations, is a fee of $75. This fee is in addition to the regular annual fee of $150 for corporations and must be paid to the Nevada Secretary of State. It is important to submit the form and the associated fee within the specified filing period to avoid incurring any penalties.

How can I get form nevada?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific employee nevada form and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit wages nevada on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit nevada nucs 4075.

How do I complete nucs 4075 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 2012 nevada nucs 4075 correct form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your form nevada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wages Nevada is not the form you're looking for?Search for another form here.

Keywords relevant to 4075 form

Related to form nucs only

If you believe that this page should be taken down, please follow our DMCA take down process

here

.